40 treasury bonds coupon rate

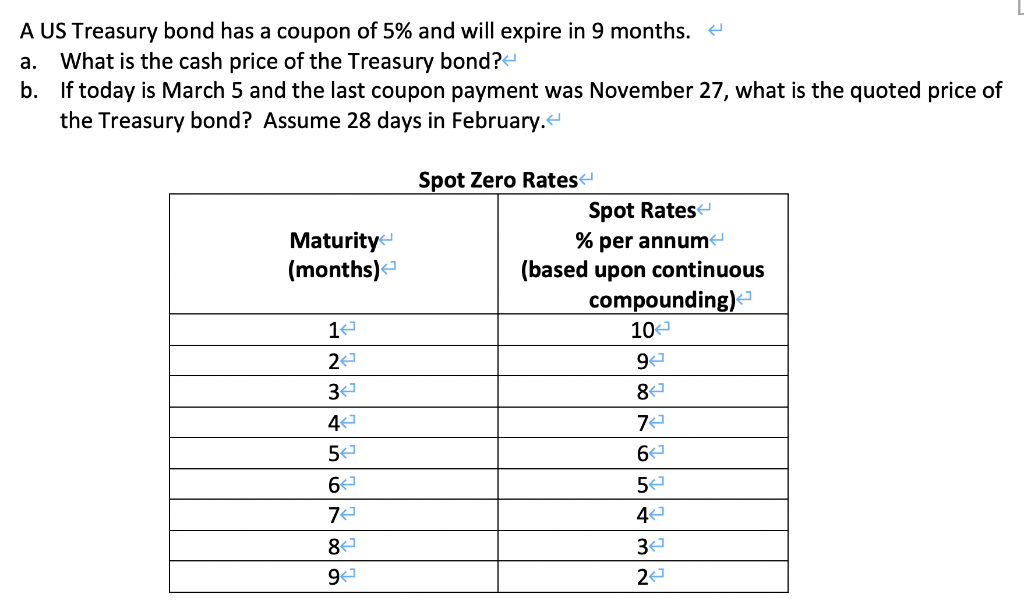

U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is an... Treasury Bonds | CBK Find the bond's coupon rate, maturity date and issue date using our Treasury Bonds Results table above. You'll find a full schedule of the bond's interest payments in its prospectus, which you can search for in our Treasury Bonds Prospectuses table above.

› us-treasury-bondsUS Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount . Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

Treasury bonds coupon rate

US Treasury Zero-Coupon Yield Curve US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,282 datasets) Refreshed 2 hours ago, on 16 May 2022 Frequency daily Description These yield curves... US Treasury Now Offering 7.12% Interest Rate on Series I ... Ouch! If you have at least $25 to invest and you're open to the idea of buying savings bonds, the U.S. Department of the Treasury is currently paying a 9.62% annual rate on Series I Bonds purchased now through October of 2022. A Series I Bond is a nearly risk-free inflation-protected investment, making it an option worth considering for ... India Government Bonds - Yields Curve 10 Years vs 2 Years bond spread is 99.7 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.40% (last modification in May 2022). The India credit rating is BBB-, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 107.14 and implied probability of default is 1.79%.

Treasury bonds coupon rate. Treasury Rates, Interest Rates, Yields - Barchart.com Treasury Rates. This table lists the major interest rates for US Treasury Bills and shows how these rates have moved over the last 1, 3, 6, and 12 months. Click on any Rate to view a detailed quote. Treasury bills, notes and bonds are sold by the U.S. Treasury Department. Treasury I-Bonds are Paying 9.62%! — Sapient Investments Treasury I-Bonds are paying 9.62% until November 1, 2022! You can only buy up to $10,000 worth each year ($20,000 for a couple), so act now to fill your 2022 order, and then in January 2023 buy another $10,000 each. It's a slam-dunk fixed income winner! US5Y: U.S. 5 Year Treasury - Stock Price, Quote and ... - CNBC 10-year Treasury yield pulls back to 2.84% as investors rotate into bonds for safety 4 Hours Ago CNBC.com 10-year Treasury yield dips back below 3% after hotter-than-expected inflation data May 11 ... US 10 year Treasury Bond, chart, prices - FT.com US 10 year Treasury, interest rates, bond rates, bond rate

20 Year Treasury Rate - YCharts The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an effort to curb inflation. 20 Year Treasury Rate is at 3.43%, compared to 3.35% the previous market day and 2.14% last year. This is lower than the long term average of 4.38%. Report. Treasury Return Calculator, With Coupon Reinvestment Treasury Return Calculator, With Coupon Reinvestment The Treasury Return Calculator below uses long run 10-year Treasury Data from Robert Shiller to compute returns based on reinvesting the coupon payments. You can see the total returns for the 10 Year Treasury for any arbitrary period from 1871 until today. United States Rates & Bonds - Bloomberg EGP T-Bonds EGP Treasury Coupon Bonds Auctions According to the Primary Dealers System. Tenor (Years) 3. 7. Auction date. 08/05/2022. 09/05/2022. Issue date. 10/05/2022.

US 10 year Treasury Bond, chart, prices - FT.com Dollar strengthens as global growth and inflation fears mount May 12 2022; Tether: stablecoin sees stable foundation shaken May 12 2022; European corporate bonds hit by steepest sell-off in at least 20 years May 12 2022; BlackRock slams 'micromanaging' climate proposals May 11 2022; Nasdaq Composite slides 3.2% as stock sell-off gathers pace May 11 2022 ... Only 4 Days Left To Buy I Bonds Paying 8.5% Before the May 2021 six month I bonds tranche paid 3.54%, these bonds interest rate had ranged from 1.06% to 2.53% since May 2008, a period of 13 years. With its rate skyrocketing to 7.12% ... I Bonds Rates Will Increase To 9.62% (May 2022 Update ... Using the formula below, we can determine the minimum rate an I Bond buyer would get starting in November 2021: Total rate = Fixed rate + 2 x Semiannual inflation rate + (Semiannual inflation rate X Fixed rate) Total rate = 0.000 + 2 x 3.56 + (3.56 x 0) Total rate = 7.12% November 2021 - April 2022 I Bond Rates When Interest rates Go up, Prices of Fixed-rate Bonds Fall interest rates. Interest rate risk is common to all bonds, particularly bonds with a fixed rate coupon, even u.s. treasury bonds. (Many bonds pay a fixed ...5 pages

U.S. Treasury Bond Options Quotes - CME Group Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures. Total Cost Analysis

US30Y: U.S. 30 Year Treasury - Stock Price, Quote ... - CNBC Yield Day High 3.055% Yield Day Low 2.956% Yield Prev Close 3.042% Price 85.6094 Price Change +1.0469 Price Change % +1.2383% Price Prev Close 84.5625 Price Day High 86.0938 Price Day Low 84.3281...

Treasury Bills | Constant Maturity Index Rate Yield Bonds ... Bankrate.com displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers.

Coupon Rate - Meaning, Example, Types | Yield to Maturity ... Thus the coupon would be-. Coupon = 0.09 X 500.00 = USD 45.00. This means that bondholders of this bond will get USD 45.00 every year up until 2024 i.e. year of maturity. The tricky thing is the coupon rate of a bond also affects the price of the bonds in the secondary market. The bonds price is sensitive to the coupon rate.

Bonds Treasury Securities and Programs; ... Interest Rate Data; ... The annual purchase limit for Series I savings bonds in TreasuryDirect® is $10,000. Purchases exceeding ...

› treasury-bills-vs-bondsTreasury Bills vs Bonds | Top 5 Best Differences (With ... Treasury bills are short term money market instruments whereas Treasury Bonds are long term capital market instruments. Treasury bills are issued at a discounted price whereas Treasury Bonds pay interest every six months to holders of a bond. Treasury bills mature in a year or less whereas Treasury bonds have a maturity greater than 10 years.

U.S. 10 Year Treasury Note Overview (TMUBMUSD10Y) | Barron's Complete U.S. 10 Year Treasury Note bonds overview by Barron's. View the TMUBMUSD10Y bond market news, real-time rates and trading information. ... Coupon Rate 1.875%. Maturity Feb 15, 2032.

10-Year Treasury Note Definition - Investopedia Below is a chart of the 10-year Treasury yield from March 2019 to March 2020. Over that span, the yield steadily declined with expectations that the Federal Reserve would maintain low interest...

Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10 ... Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-05-06 about 10-year, bonds, yield, interest rate, interest, rate, and USA.

› instit › annceresultPrice, Yield and Rate Calculations for a Treasury Bill ... Calculate Coupon Equivalent Yield In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. In this formula they are addressed as: a, b, and c. 364 0.25 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one half-year to maturity

How Do Treasury Bond Interest Rates Work? (Explained) Coupon rate = the interest rate you receive at maturity or in installments during lending period. Bond markets control the world… It is the largest market on earth and it is the "tail that wags the dog." The bond market is $119 trillion globally and stock market is $41.8 globally in contrast. Bond holders get paid out first…

10 Year Treasury Rate - YCharts Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 2.91%, compared to 2.99% the previous market day and 1.64% last year. This is lower than the long term average of 4.28%. Stats Related Indicators Treasury Yield Curve

Treasury Announces First State Small Business Credit ... WASHINGTON — Today, the U.S. Department of the Treasury announced the first group of plans approved under the new round of the State Small Business Credit Initiative (SSBCI). The American Rescue Plan reauthorized and expanded SSBCI, which was originally established in 2010 and was highly successful in increasing access to capital for traditionally underserved small businesses and ...

I Bonds Are More Appealing Than Ever. Here's Why - CNET While the fixed rate dictated by the US Treasury may change every six months, I bonds maintain the fixed rate they were issued under for their lifetime (up to 30 years). Currently, the fixed rate...

Treasury bonds paying an 8% coupon rate with semiannual ... Treasury bonds paying an 8% coupon rate with semiannual payments currently sell at par value. What coupon rate would they have to pay in order to sell at par if they paid their coupons annually? (Do not round intermediate calculations. Round your answer to 2 decimal places.) May 09, 2022 SOLUTION.PDF SOLUTION.PDF Get Answer To This Question

BONDS | BOND MARKET | PRICES | RATES | Markets Insider The coupon shows the interest that the respective bond yields. The issuer of the bond takes out a loan on the capital market and therefore owes a debt to the purchaser of the bond.

India Government Bonds - Yields Curve 10 Years vs 2 Years bond spread is 99.7 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.40% (last modification in May 2022). The India credit rating is BBB-, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 107.14 and implied probability of default is 1.79%.

Post a Comment for "40 treasury bonds coupon rate"