38 difference between coupon rate and market rate

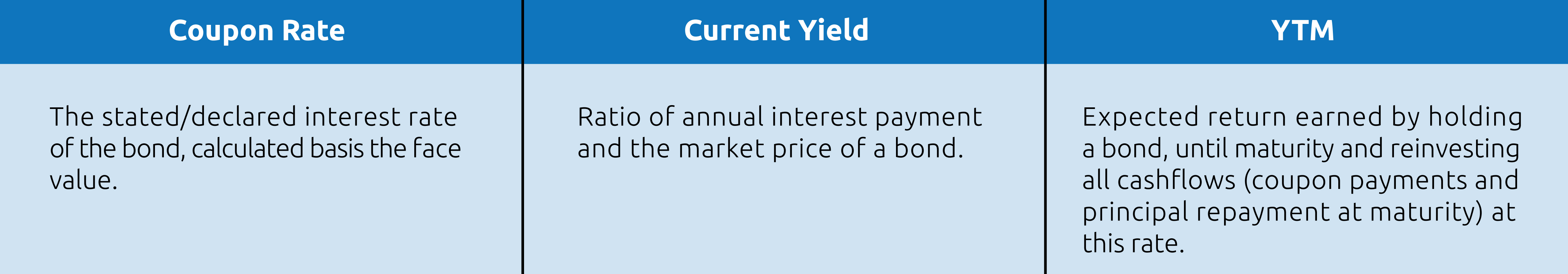

What is the difference between a zero-coupon bond and a ... Aug 31, 2020 · The difference between a regular bond and a zero-coupon bond is the payment of interest, otherwise known as coupons.A regular bond pays interest to bondholders, while a zero-coupon bond does not ... Difference between Yield Coupon Rate - Difference Betweenz The coupon rate is one factor that helps them determine how much income a bond will generate. Other factors include the length of time until the bond matures and market conditions. For example, when interest rates rise, newly issued bonds will have higher coupon rates than existing bonds. Difference between Yield Coupon Rate

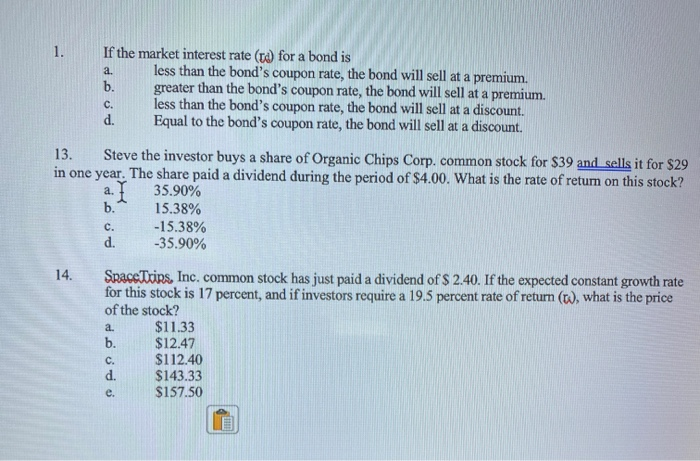

Difference Between Coupon Rate and Required Return The coupon rate does is independent of the market value. The required return is dependent on the dividend value. The coupon rate is directly dependent on the bond price, whereas the required return is directly dependent on the risk involved. Coupon Rate has a risk on investment due to the fluctuations of the coupon rate.

Difference between coupon rate and market rate

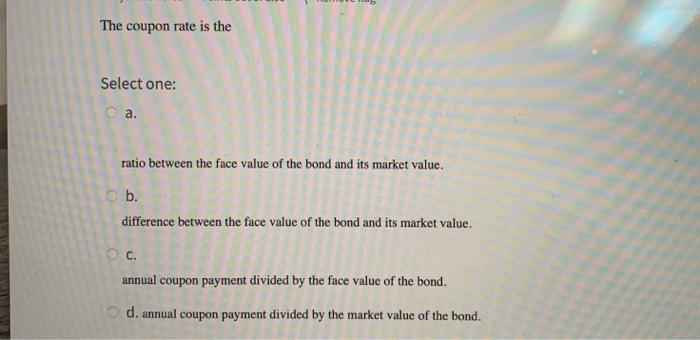

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%.... What is the Coupon Rate? - Realonomics The main difference between Coupon Rate and Interest Rate is that the coupon rate has a fixed rate throughout the life of the bond. Meanwhile, the interest rate changes its rate according to the bond yields.The coupon rate is the annual rate of the bond that has to be paid to the holder. Option (finance) - Wikipedia The first part is the intrinsic value, which is defined as the difference between the market value of the underlying, and the strike price of the given option The second part is the time value , which depends on a set of other factors which, through a multi-variable, non-linear interrelationship, reflect the discounted expected value of that ...

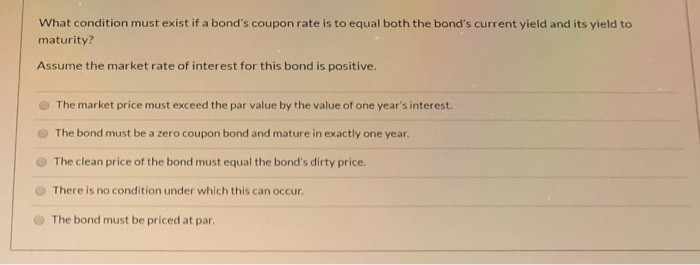

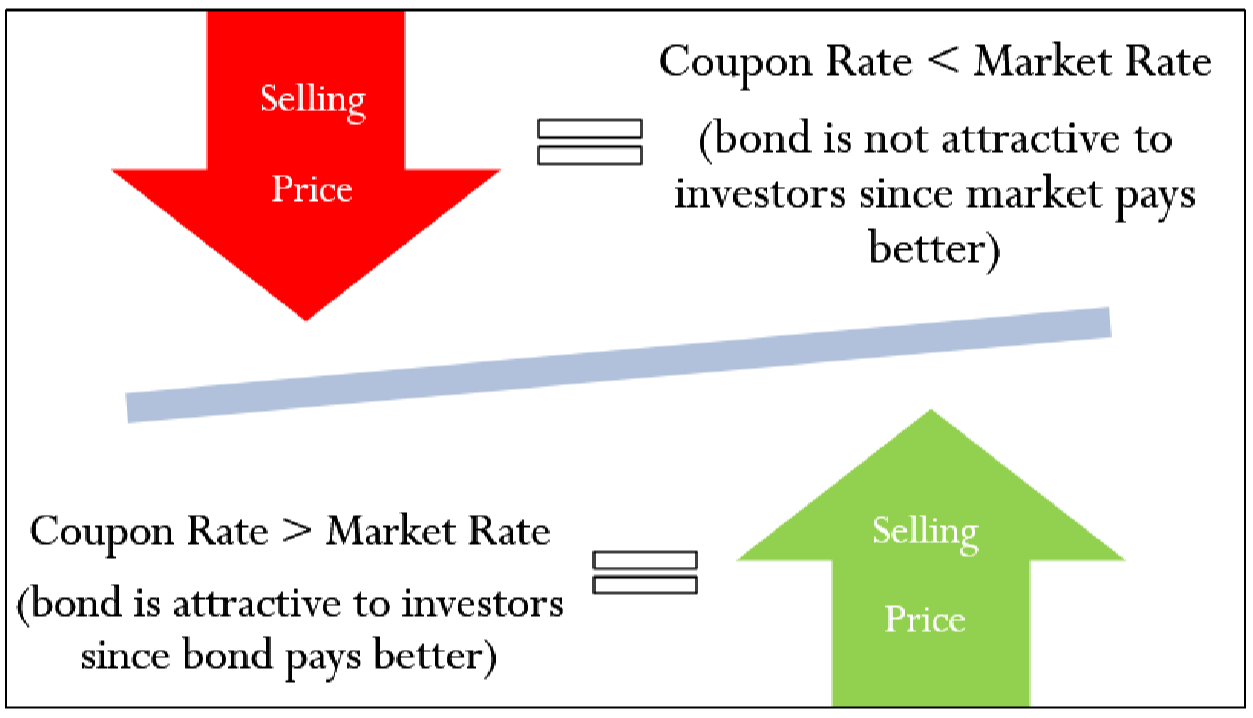

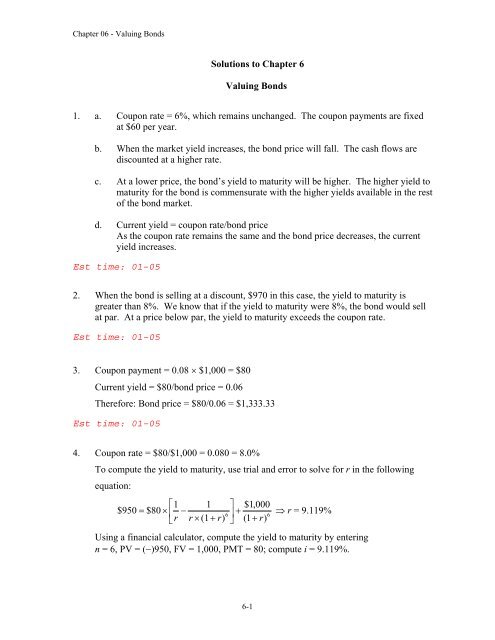

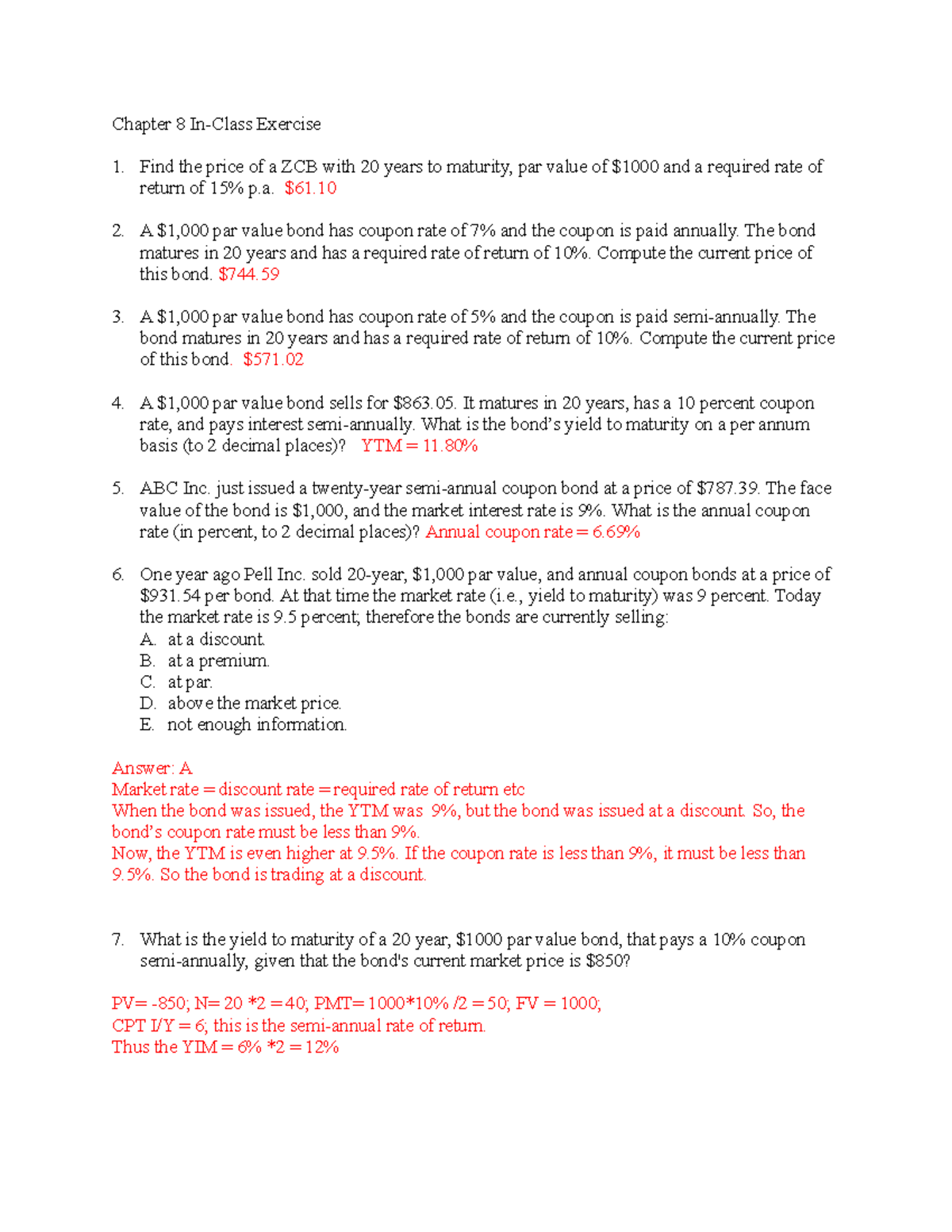

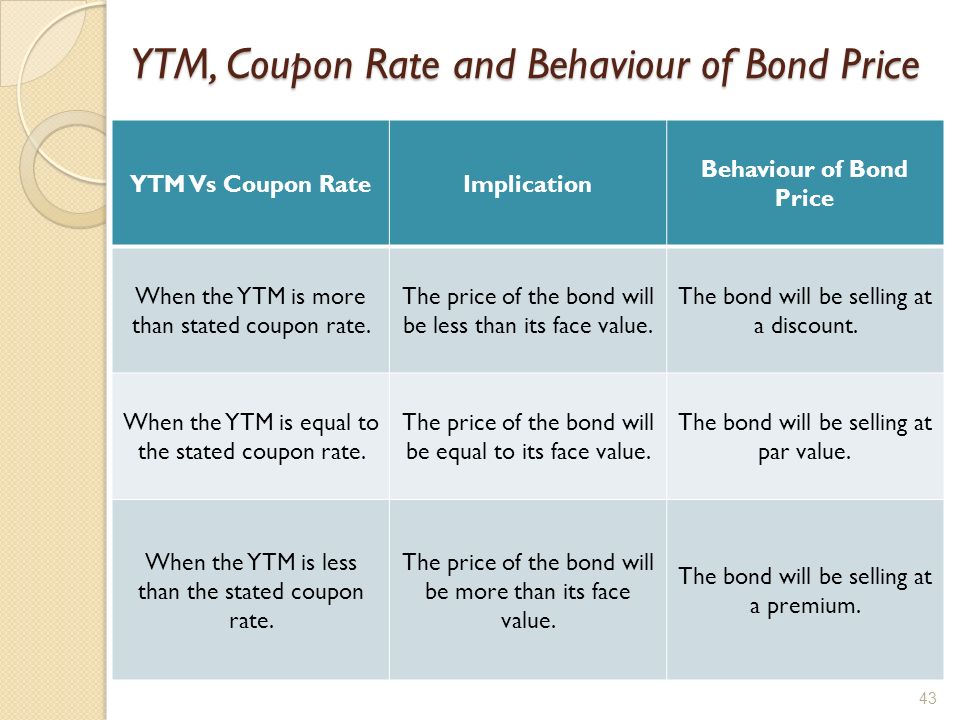

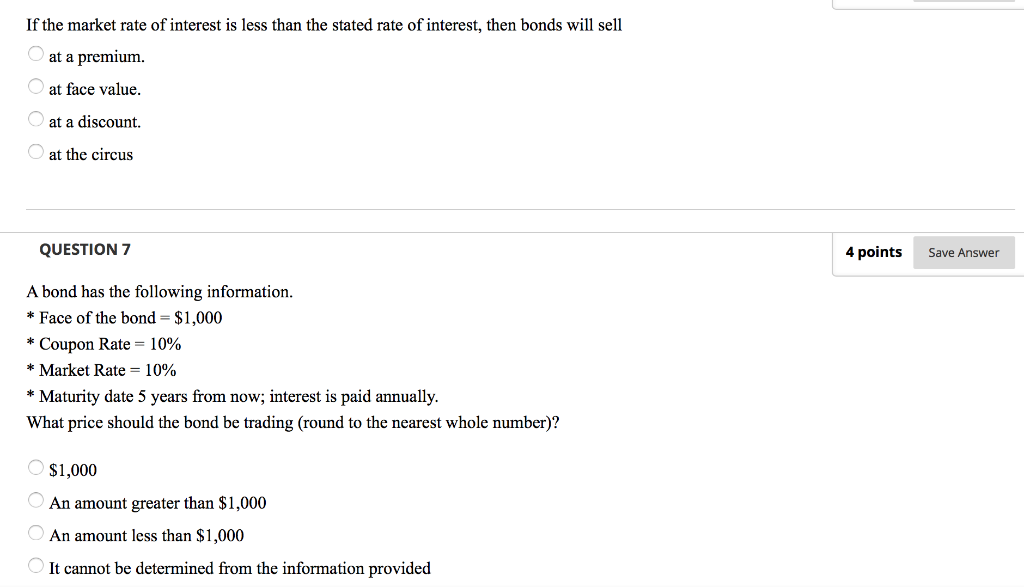

Difference between coupon rate and market rate. What's the difference between the cost of debt and a coupon rate? The Coupon Rate is 9%. It pays $90 per year since it was issued $90 is 9% of the original $1000 investment. The Bond Yield (aka, Current Yield) is 10%. 10% is your return this year, if you buy the bond at today's prices $90 is 10% of your $910 investment. The Yield to Maturity (YTM) is 13%. It's the only number that really matters. Difference between YTM and Coupon Rates where "Coupon Payment" is the periodic interest payment made by the issuer, "Par Value" is the face value of the bond that's paid at maturity, "Market Price" is the current price of the bond, and "n" is the number of years until maturity. What is the Coupon Rate? What is the difference between a coupon rate and a yield rate? Coupon rate is the rate of interest. Rate of Yield is the total interest earned as a percentage of the principal amount. Principal amount 10000 Coupon or interest rate per annum = 10 % The yield after one year = 10000x 10% = 1000 The yield percentage is 1000/ 10000 = 10 % Principal 11000 The yield after 2 years is 11000x 10 % = 1100 What's the Difference Between Premium Bonds and Discount Bonds? A premium bond has a coupon rate higher than the prevailing interest rate for that bond maturity and credit quality. A discount bond, in contrast, has a coupon rate lower than the prevailing interest rate for that bond maturity and credit quality. An example may clarify this distinction. Let's say you own an older bond—one that was ...

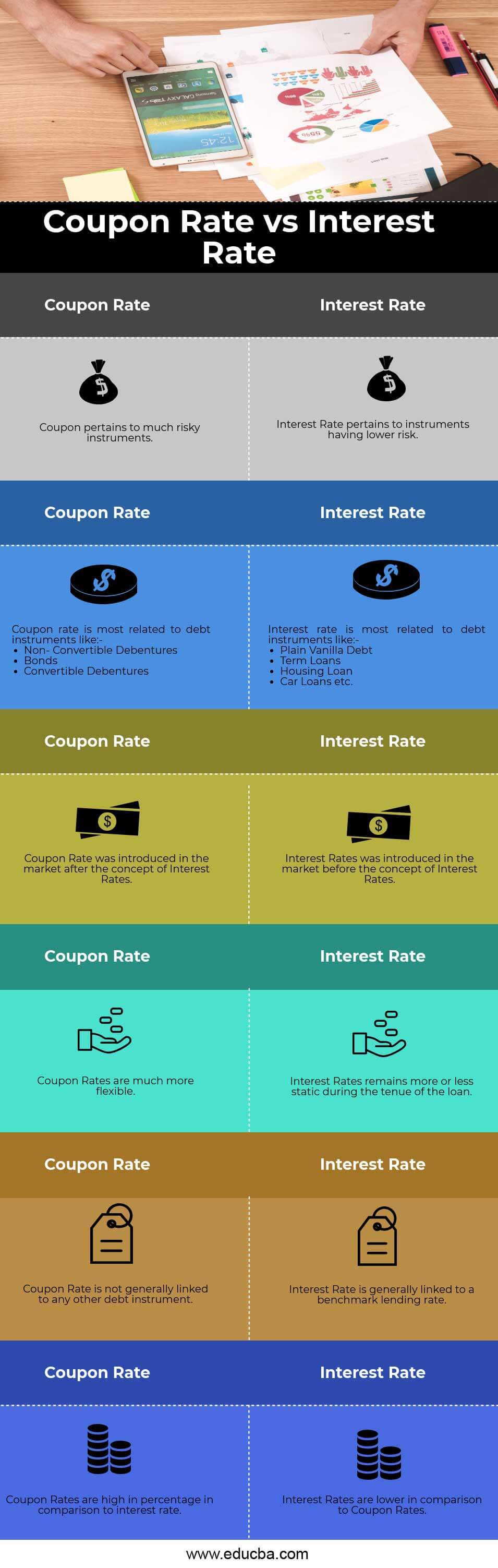

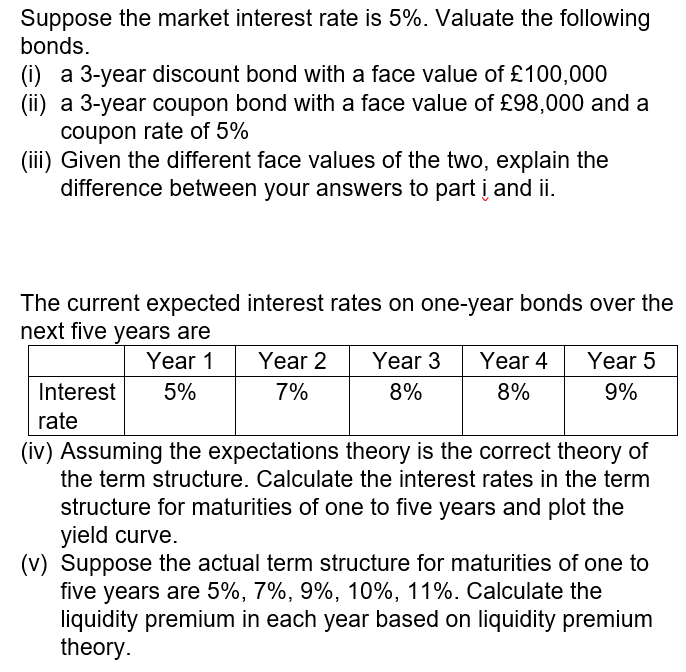

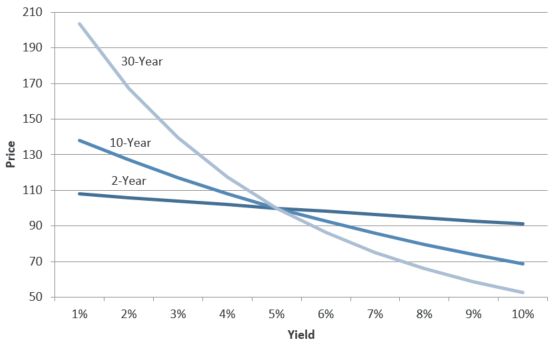

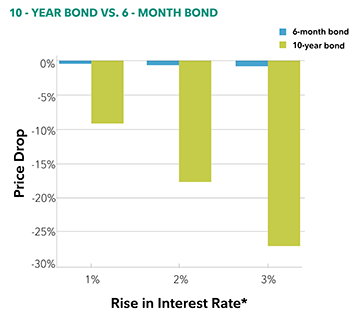

Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements. Difference Between Coupon Rate and Interest Rate Main Differences Between Coupon Rate and Interest Rate Coupon rates are calculated on the fixed-income security, whereas interest rates are calculated on the amount which has been lent to borrowers. The coupon's face value determines the nominal value of the bond. Albeit the Interest rate's face value affected by the amount due on. Interest Rate Risk Between Long-Term and Short-Term Bonds Mar 18, 2022 · Find out the differences and effects of Interest rates between Long-term and short-term bonds. Read how interest rate risk affect and impact these bonds and learn how you could avoid it. The Difference Between Coupon and Yield to Maturity - The Balance Mar 04, 2021 · Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%.

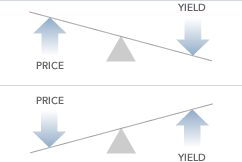

Forward Rate vs. Spot Rate: What's the Difference? - Investopedia Jun 30, 2022 · The restaurant has an immediate business need and must pay the current market price in exchange for the goods to be delivered on time. ... The difference between the spot rate and forward rate is ... What is the difference between the coupon rate and the current market ... Basically, what drives these market powers is the contrast between the current market interest for investments of a similar risk level as the security, and the bond's own coupon rate. Hence if a security has a coupon rate underneath current market interest rates, its reasonable worth will be beneath its face value of $1,000 and the other way ... Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA 3. Interest rates influence the coupon rates. The current yield compares the coupon rate to the market price of the bond. 4. The coupon amount remains the same until maturity. Market price keeps on fluctuating, better to buy a bond at a discount which represents a larger share of the purchase price. 5. Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia It is the sum of all of its remaining coupon payments. A bond's yield to maturity rises or falls depending on its market value and how many payments remain to be made. The coupon rate is the...

Difference Between Coupon Rate and Interest Rate What is the difference between Coupon Rate and Interest Rate? • Coupon Rate is the yield of a fixed income security. Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending.

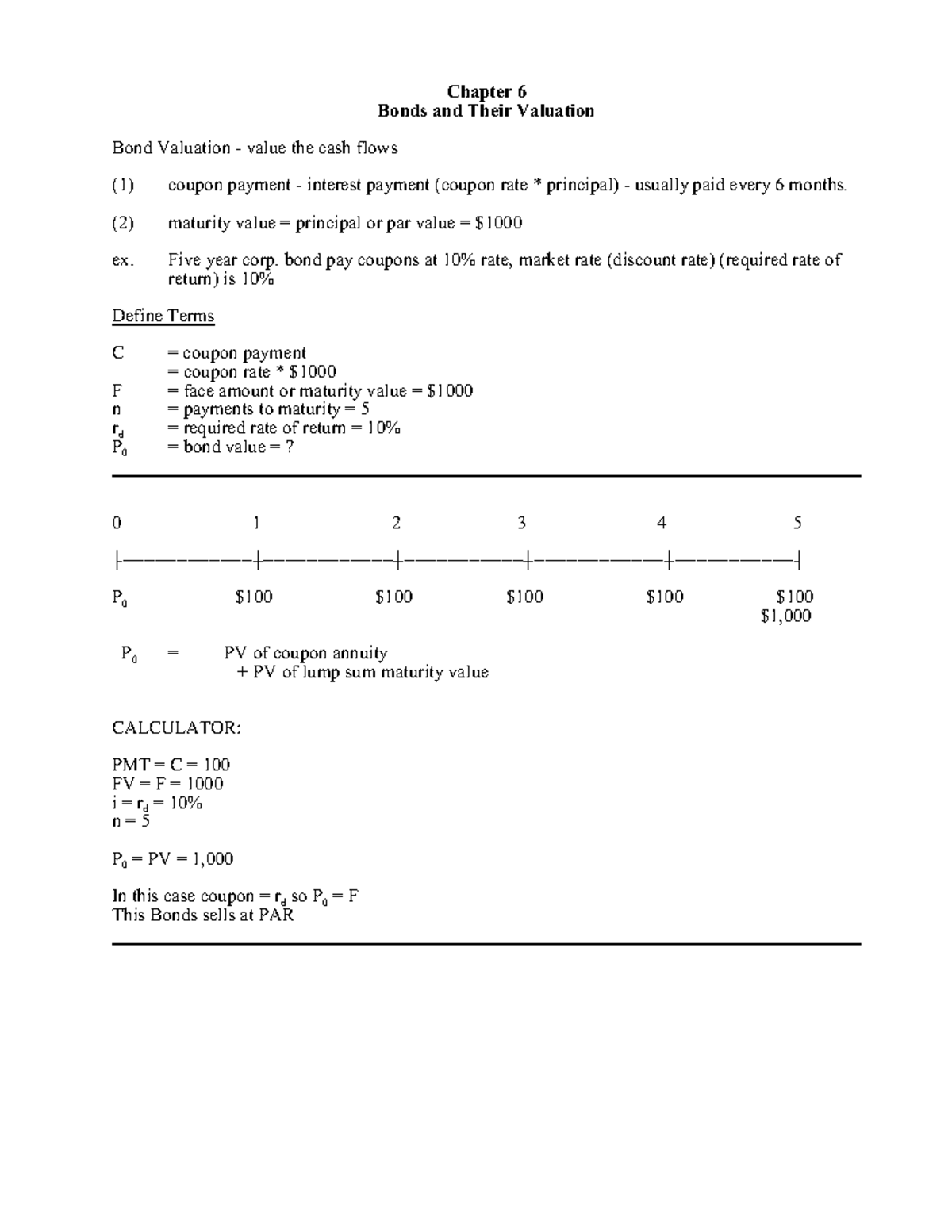

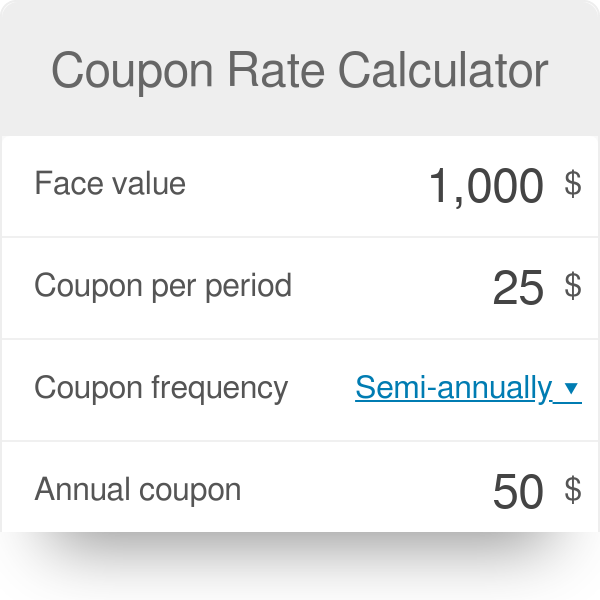

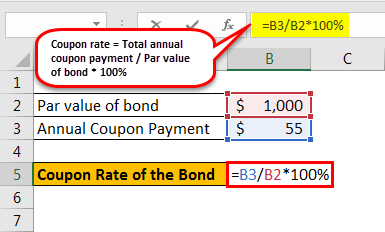

What is 'Coupon Rate' - The Economic Times What is 'Coupon Rate' Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Learn How Coupon Rate Affects Bond Pricing 11 Oct 2022 — The yield-to-maturity only equals the coupon rate when the bond sells at face value. The bond sells at a discount if its market price is below ...

Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

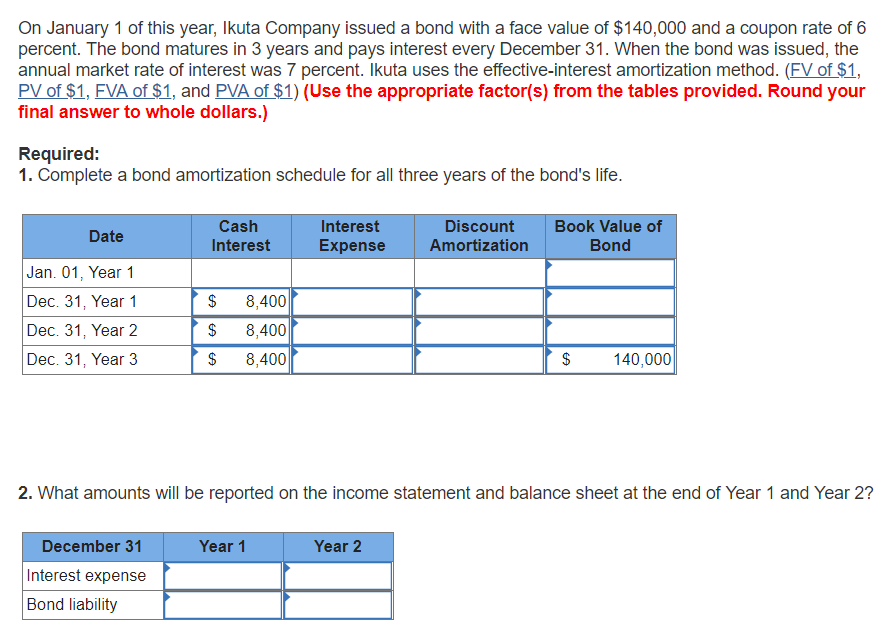

The Difference between a Coupon and Market Rate - BrainMass Coupon rate is the interest rate to be paid on the bond at regular interval. In this case coupon rate is 8%. If the face value of the bond is $1000, the holder of the bond will receive $80 at the end of every year during the duration of the bond. In addition the bond holder will receive $1000 back on the maturity of the ... Solution Summary

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%.

Finance exam 2 Flashcards | Quizlet It is also the expected return for an investor who buys the bond and holds it to maturity. The coupon rate determines the periodic interest payments made to investors. YTM is the expected return for an investor who buys the bond today and holds it to maturity. YTM is the prevailing market interest rate for bonds with similar features.

What is the difference between the coupon rate and the market interest ... The coupon rate on the bond is the amount that is listed on the face of the bond. The market rate is the rate that is paid on the open market and will constantly change due to things like global events, company events, and other economic issues. Let me know if you need anything else. If not, please leave a rating. Thanks!

Answered: What is the difference between the… | bartleby Q: What is the difference between the coupon rate and the current market interestrate of a bond? A: It is the yearly interest rate rewarded to the bondholders. It stated as a percentage of face value.…

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · What Is the Difference Between a Bond's Coupon and Yield? ... To compensate for this, the bond will be sold at a discount in secondary market. Although the coupon rate will remain 3%, the lower ...

Difference Between Coupon Rate and Interest Rate - diffzy.com The critical difference between coupon rate and interest rate is that interest rate is a fixed rate throughout the life of the investment, while the coupon rate changes from time to time, depending upon market conditions. The coupon rate is always estimated on the par value/ face value of the investment.

Bond Stated Interest Rate Vs. Market Rate - PocketSense Because of the manner in which bonds are traded, the coupon rate often differs from the market interest rate. Tips A coupon rate is a fixed rate of return attached to the face value of the bond paid to the purchaser from the seller, while the market interest rate can change dramatically throughout the lifespan of the bond. Bond Basics

Solved What is the difference between a bond's coupon rate | Chegg.com The market rate is the rate of return expected by investors who purchase the bonds. The market rate is the rate specified on the face of the bond. The coupon rate is; Question: What is the difference between a bond's coupon rate and its market interest rate (yield)? O Coupon rate and market rate are same. The coupon rate is the rate specified ...

What is the difference between coupon rate and market The market can also give a premium rate that is greater, than a discount rate. The reason its called a coupon rate is that before electronic investing each bond that was issued is made of paper called coupons. These were issued to redeem for money.

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo Key Differences For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield of a bond, the denominator is the market price of the bond.

Difference Between Coupon Rate And Yield Of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Here's another example that clearly ...

Coupon Rate vs Interest Rate - WallStreetMojo The coupon rate is decided by the issuer of the bonds to the purchaser. The interest rate is decided by the lender. Coupon rates are largely affected by the interest rates decided by the government. If the interest rates are set to 6%, then no investor will accept the bonds offering coupon rate lower than this.

Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. 1. Overview and Key Difference.

Option (finance) - Wikipedia The first part is the intrinsic value, which is defined as the difference between the market value of the underlying, and the strike price of the given option The second part is the time value , which depends on a set of other factors which, through a multi-variable, non-linear interrelationship, reflect the discounted expected value of that ...

What is the Coupon Rate? - Realonomics The main difference between Coupon Rate and Interest Rate is that the coupon rate has a fixed rate throughout the life of the bond. Meanwhile, the interest rate changes its rate according to the bond yields.The coupon rate is the annual rate of the bond that has to be paid to the holder.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%....

.png)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/GettyImages-182832748-af3f3d3824034fdaa66ac937fc2d7a40.jpg)

Post a Comment for "38 difference between coupon rate and market rate"