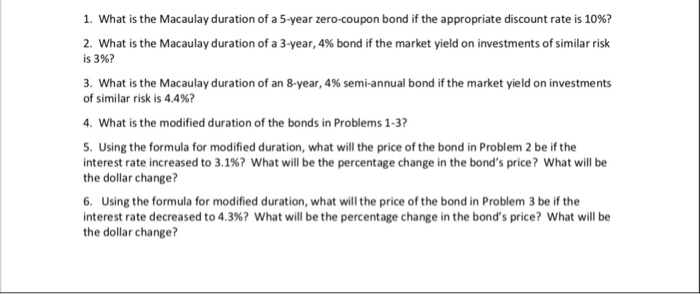

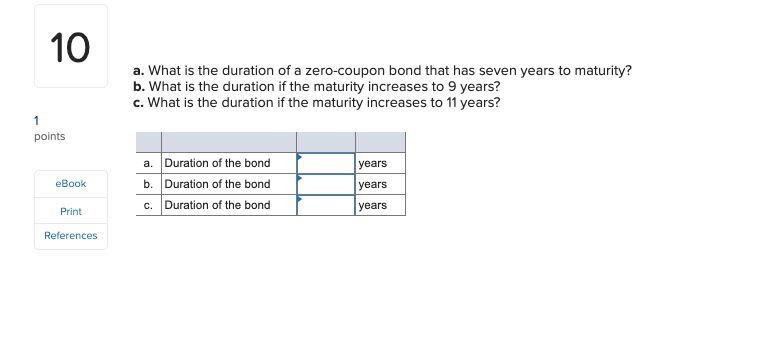

39 duration for zero coupon bond

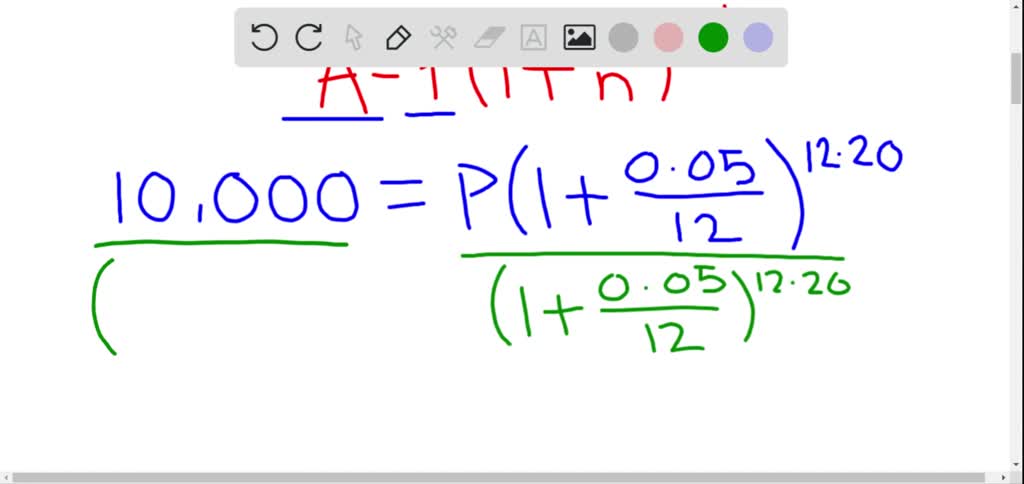

Zero Coupon Bond Calculator - Nerd Counter How to Calculate the Price of Zero Coupon Bond? The particular formula that is used for calculating zero coupon bond price is given below: P (1+r)t; Examples: Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years. How to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ...

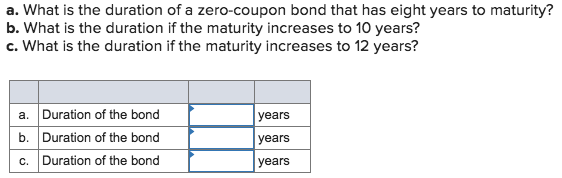

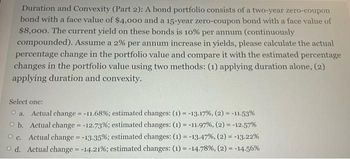

The Macaulay Duration of a Zero-Coupon Bond in Excel Aug 29, 2022 · The Macaulay duration of a zero-coupon bond is equal to the time to maturity of the bond. Simply put, it is a type of fixed-income security that does not pay interest on the principal amount.

Duration for zero coupon bond

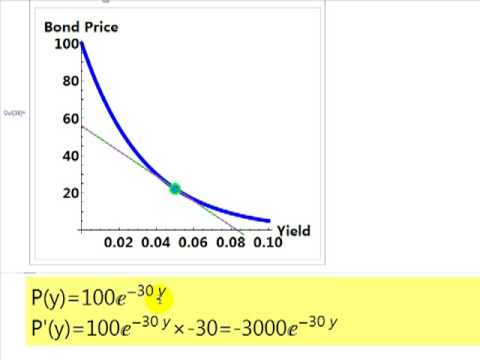

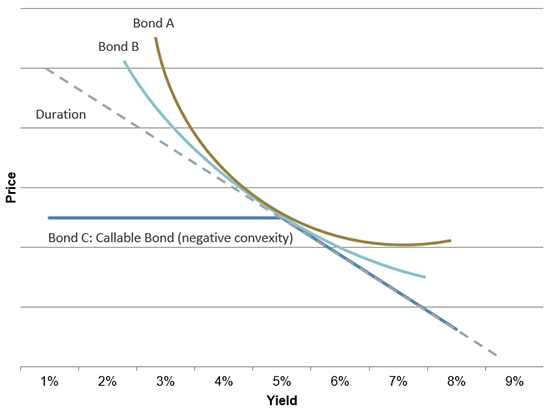

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Oct 20, 2022 · For example, you might pay $3,500 to purchase a 20-year zero coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. For this reason, zero coupon bonds are often purchased to meet a future expense such as college costs or an anticipated expenditure in retirement. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. ... Ext Duration Treasury ETF." PIMCO. "PIMCO ... Bond duration - Wikipedia For a standard bond, the Macaulay duration will be between 0 and the maturity of the bond. It is equal to the maturity if and only if the bond is a zero-coupon bond. Modified duration, on the other hand, is a mathematical derivative (rate of change) of price and measures the percentage rate of change of price with respect to yield.

Duration for zero coupon bond. Bond duration: how it works and how you can use it - Monevator Oct 25, 2022 · What is bond duration? Bond duration expresses a bond’s vulnerability to interest rate risk. The larger the bond duration number, the more reactive a bond’s price is to interest rate changes, as the bond’s yield adjusts to reflect those changes. For example, if a bond’s duration number is 11, then it: Bond duration - Wikipedia For a standard bond, the Macaulay duration will be between 0 and the maturity of the bond. It is equal to the maturity if and only if the bond is a zero-coupon bond. Modified duration, on the other hand, is a mathematical derivative (rate of change) of price and measures the percentage rate of change of price with respect to yield. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. ... Ext Duration Treasury ETF." PIMCO. "PIMCO ... The One-Minute Guide to Zero Coupon Bonds | FINRA.org Oct 20, 2022 · For example, you might pay $3,500 to purchase a 20-year zero coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. For this reason, zero coupon bonds are often purchased to meet a future expense such as college costs or an anticipated expenditure in retirement.

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "39 duration for zero coupon bond"