44 relationship between coupon rate and ytm

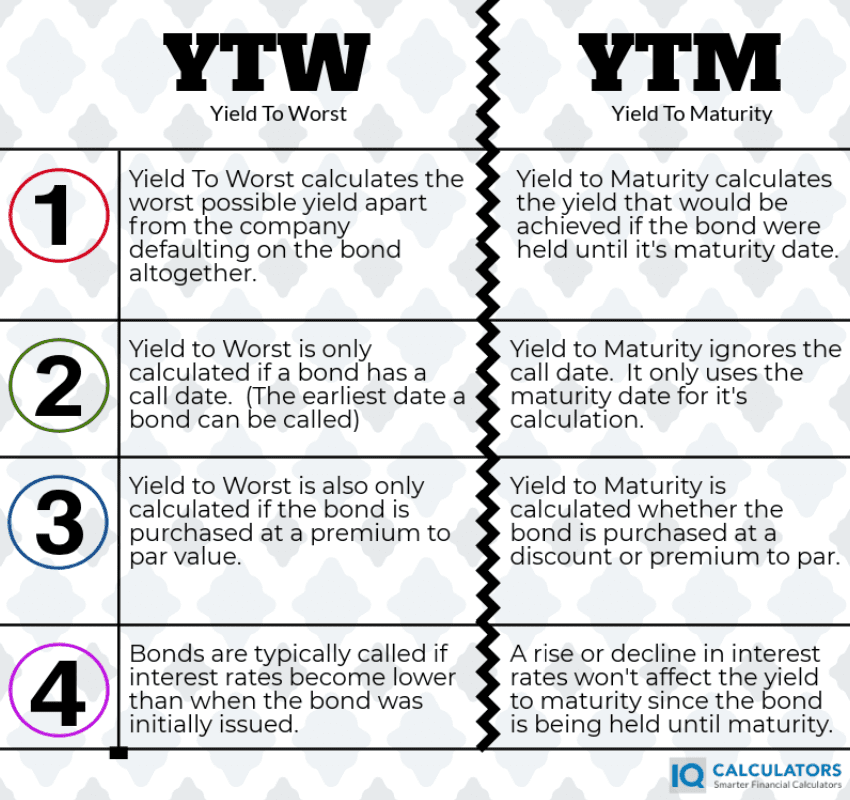

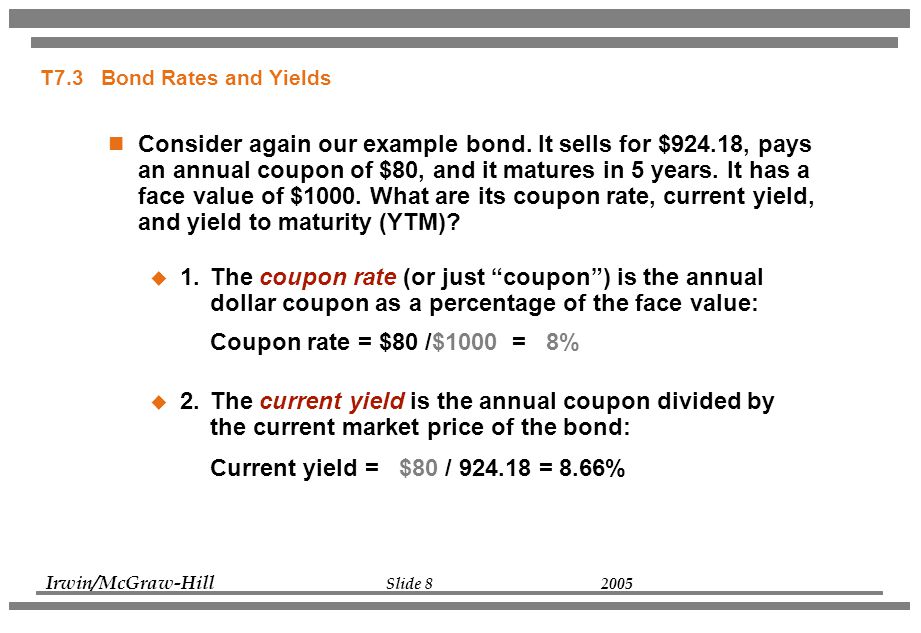

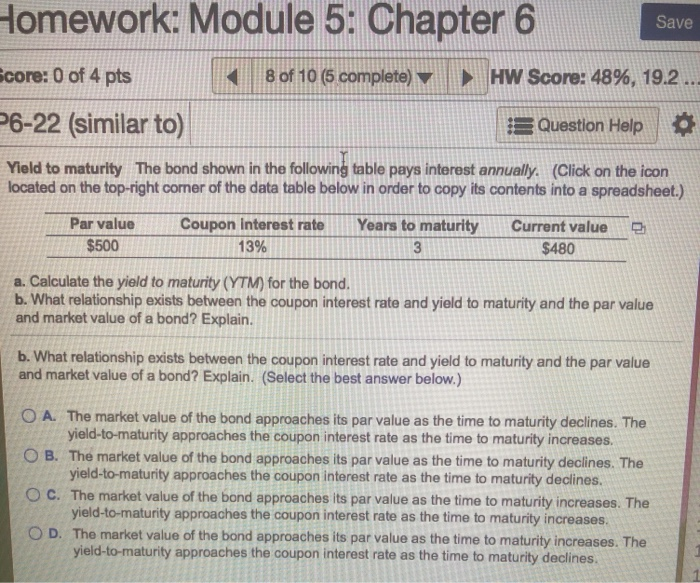

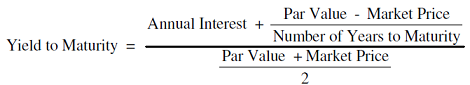

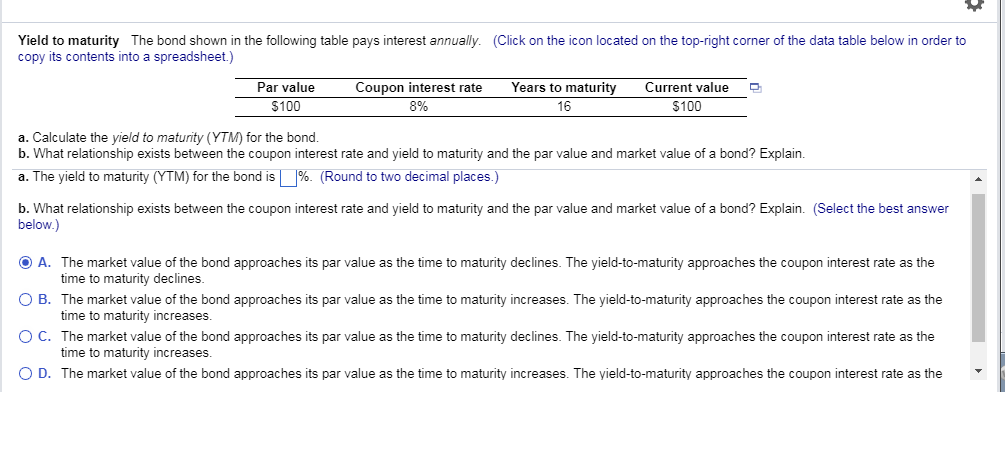

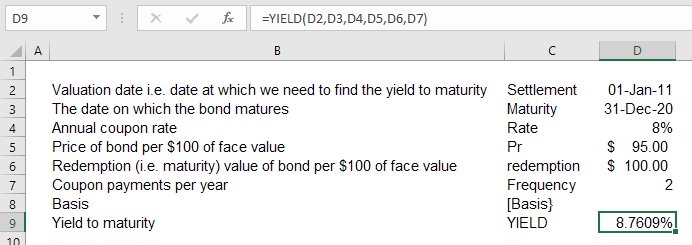

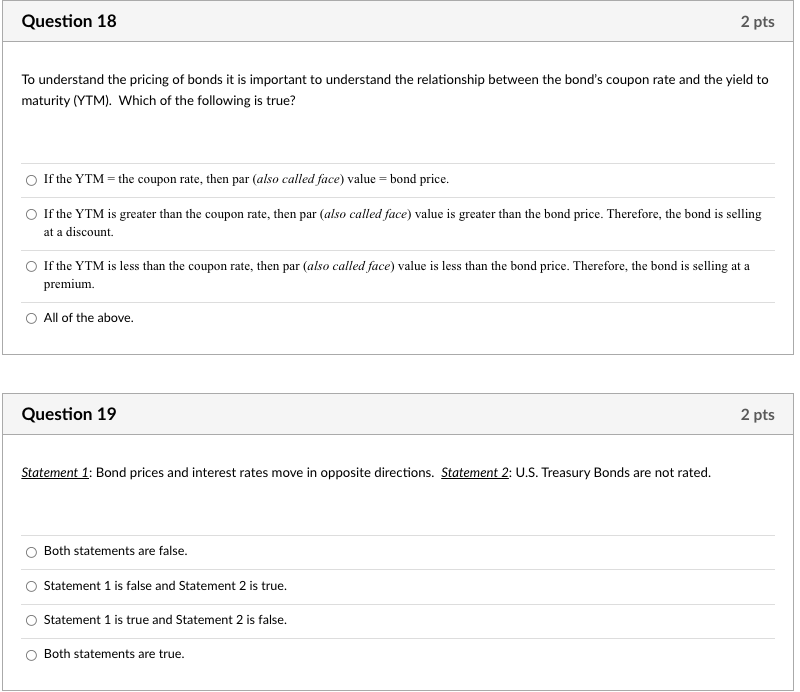

Solved a. Calculate the yield to maturity (YTM) for the | Chegg.com What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain. a. The yield to maturity (YTM) for the bond is \%. (Round to two decimal places.) Question: a. Calculate the yield to maturity (YTM) for the bond. b. Yield to Maturity (YTM): Formula and Calculator (Step-by-Step) An important distinction between a bond's YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the coupon rate is fixed. The relationship between the yield to maturity and coupon rate (and current yield) are as follows.

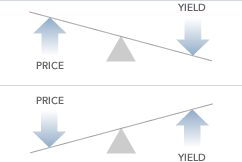

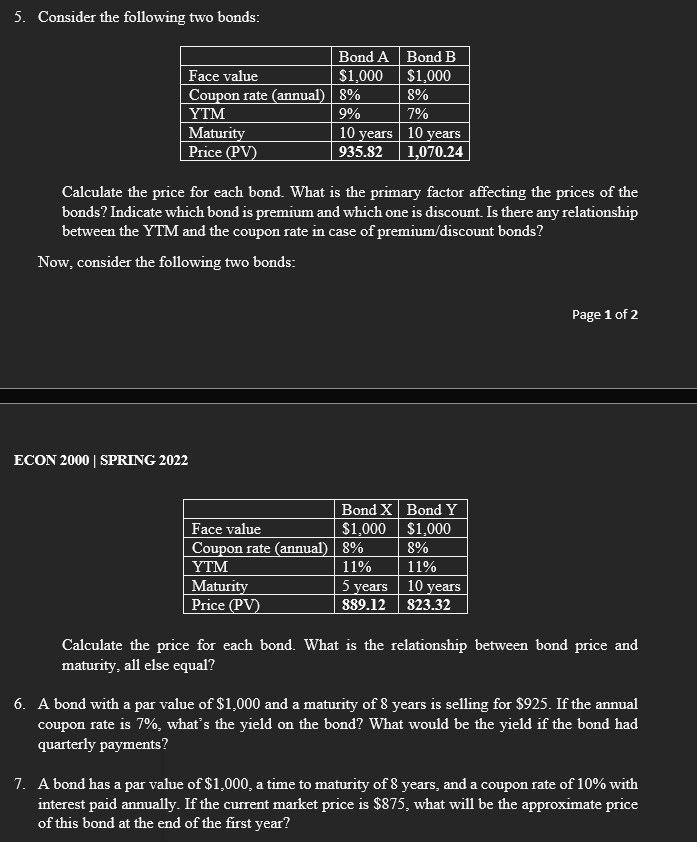

The Relationship Between a Bond's Price & Yield to Maturity If you pay $1,000 for this bond, your yield to maturity will be exactly 6 percent, as you will receive the exact amount of money you originally paid for the bond. However, if you only pay $900 for the bond, your yield to maturity will be greater because, in addition to the 6 percent interest, you'll earn a capital gain of $100.

Relationship between coupon rate and ytm

Concept 82: Relationships among a Bond’s Price, Coupon … A bond’s price moves inversely with its YTM. An increase in YTM decreases the price and a decrease in YTM increases the price of a bond. The relationship between a bond’s price … Difference between YTM and Coupon Rates 20.05.2022 · YTM accounts for both the interest payments made (the coupon rate) as well as any capital gains or losses. A coupon rate, on the other hand, is simply the interest rate that is … What relationship between a bond’s coupon rate and a bond’s … It is crucial to understand the difference between a bond’s coupon interest rate and its yield. The yield represents the effective interest rate on the bond, determined by the relationship …

Relationship between coupon rate and ytm. When is a bond's coupon rate and yield to maturity the same? - Investopedia The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value,... Difference Between Coupon Rate And Yield Of Maturity Coupon Rate or Nominal Yield = Annual Payments / Face Value of the Bond. Yield to Maturity = (C + (F-P)/n)*2/(F+P) 7; No matter at whichever price the bond is traded, the coupons are … When is a bond's coupon rate and yield to maturity the same? The Relation of Interest Rate & Yield to Maturity | Pocketsense Apr 19, 2017 · Most brokerage firms offer YTM estimates on potential purchases, and there are number of online calculators you can use to make estimates based on coupon rate and maturity date. In the example, if you paid a premium for the same six-year bond, say $101, your estimated YTM would decrease to about 4.8 percent, or about $28.80.

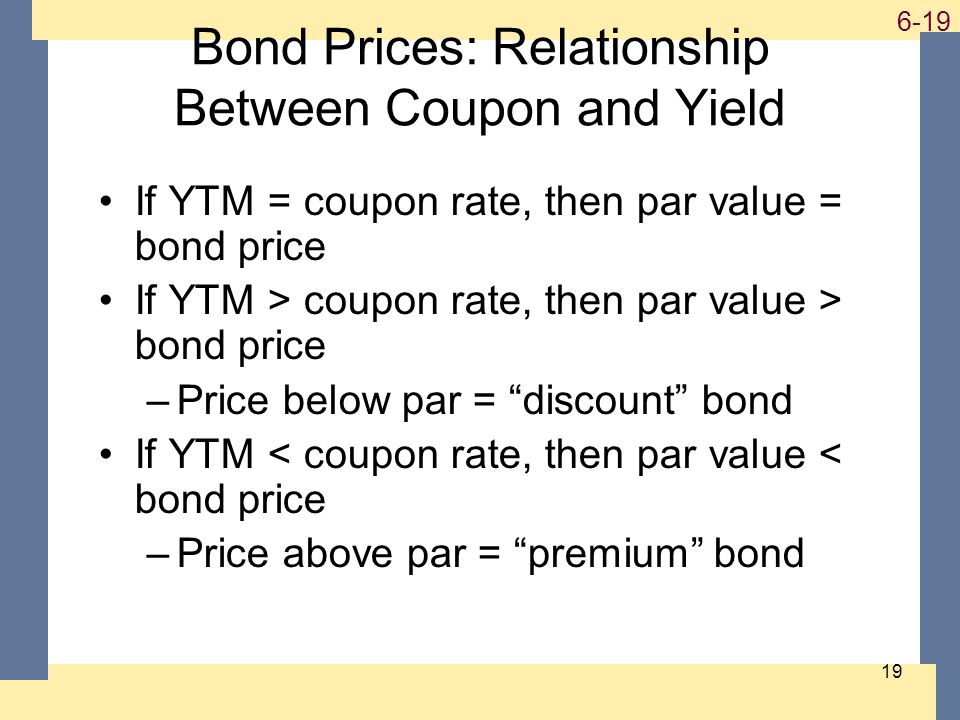

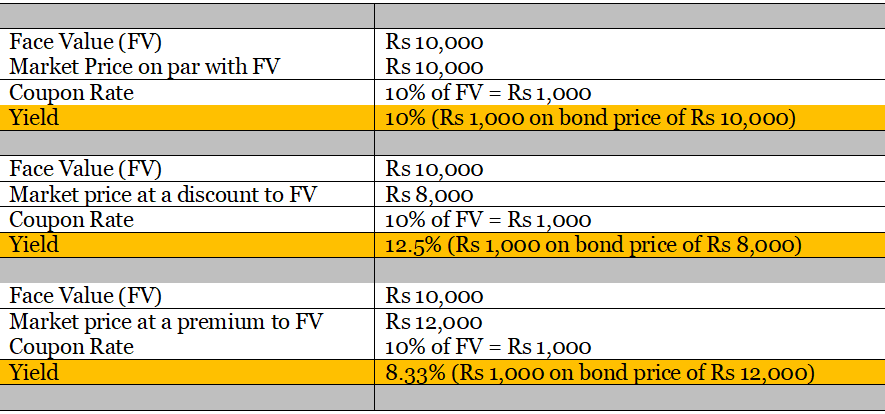

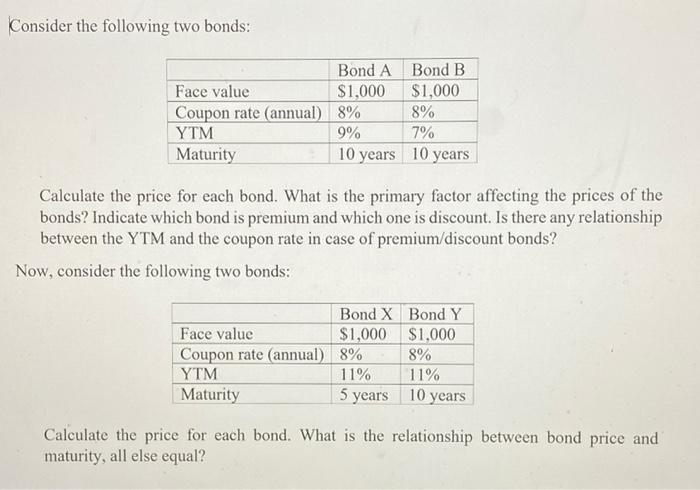

Solved Bond Prices versus Yields A. What is the relationship - Chegg A. YTM is based on the current market rate. Price of the bond is decided by the prevailing market rate which is YTM. If the YTM is higher than coupon rate, the price of the … View the full answer Previous question Next question Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Relationship Between Bond Price & Yield to Maturity If a bond has a face value of $1,000 and you pay $1,000 to buy the bond, your yield to maturity will be the same as the interest rate of the bond. However, if you pay less than $1,000 for that bond, your yield to maturity will be higher. Say, for example, you pay $900 for a bond with a face value of $1,000. In addition to the regular interest ... Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%.

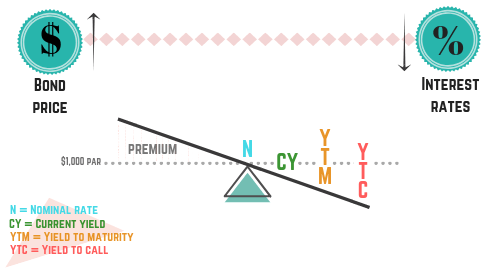

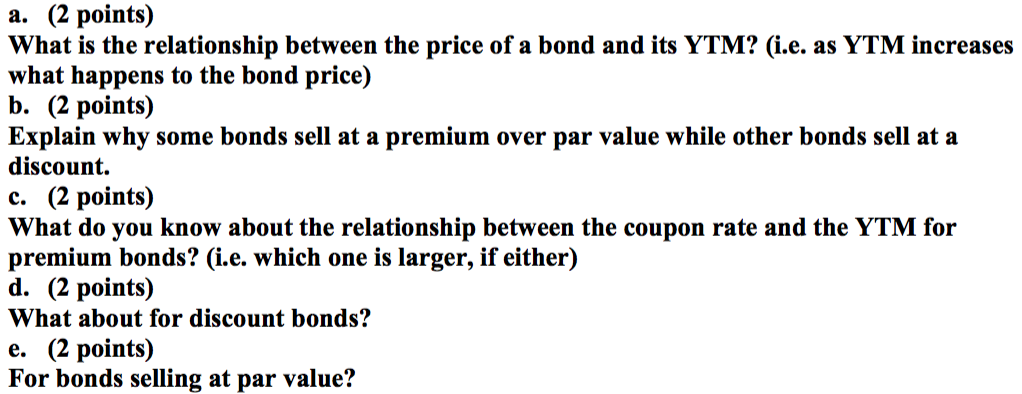

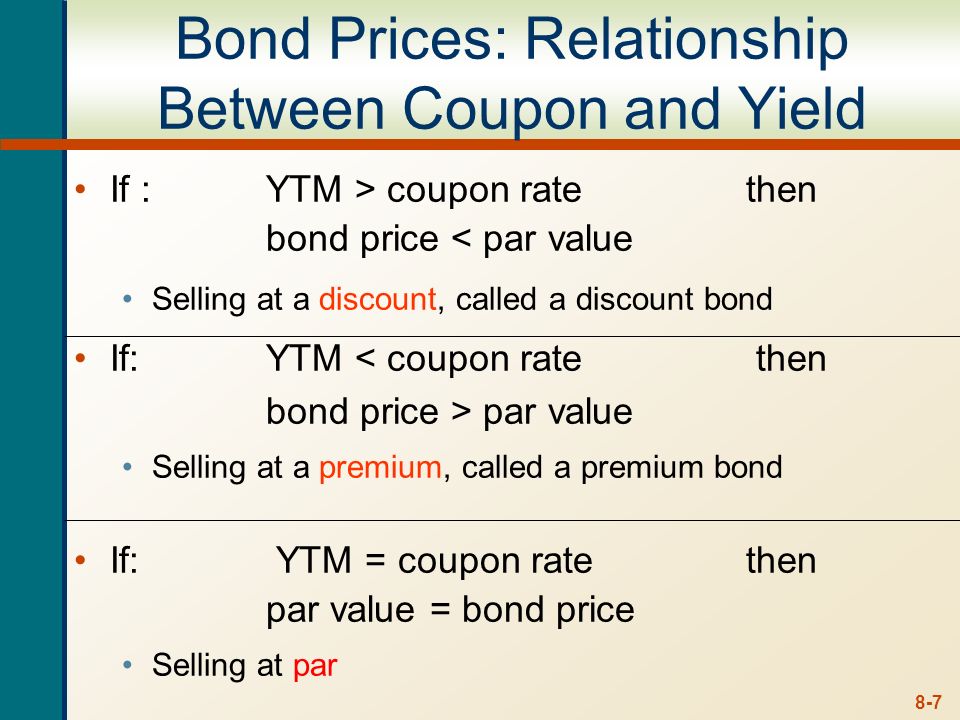

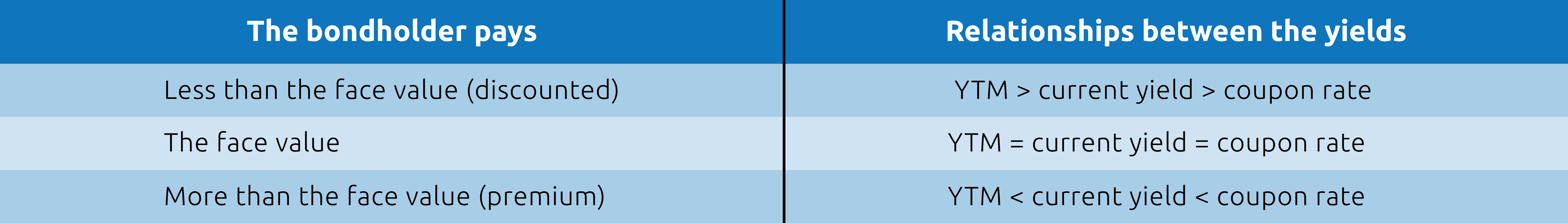

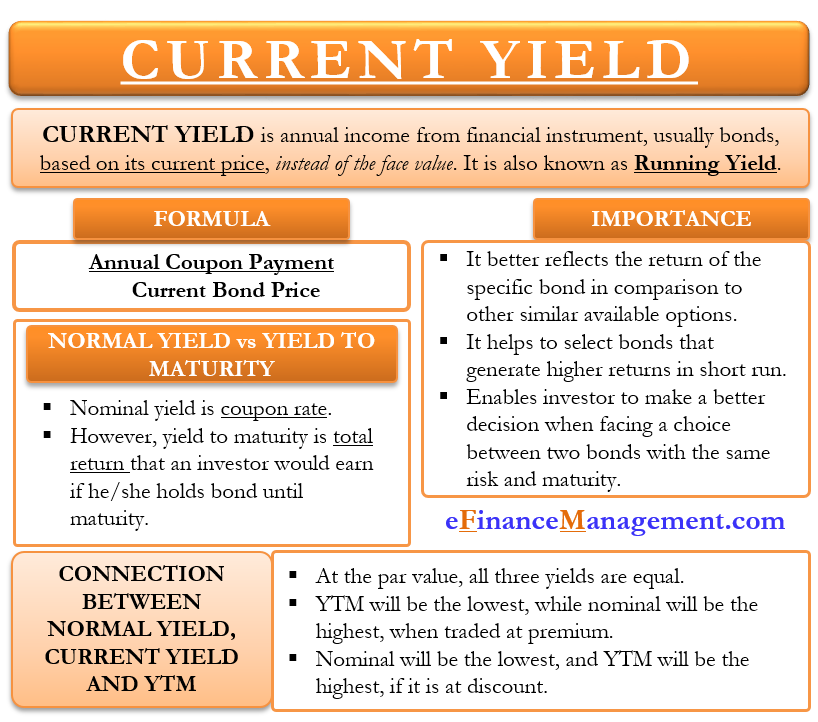

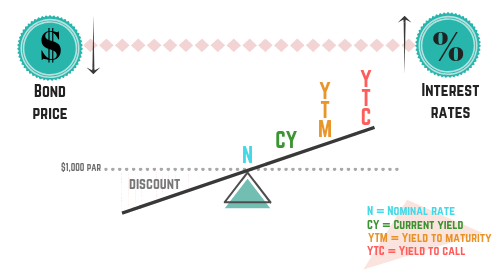

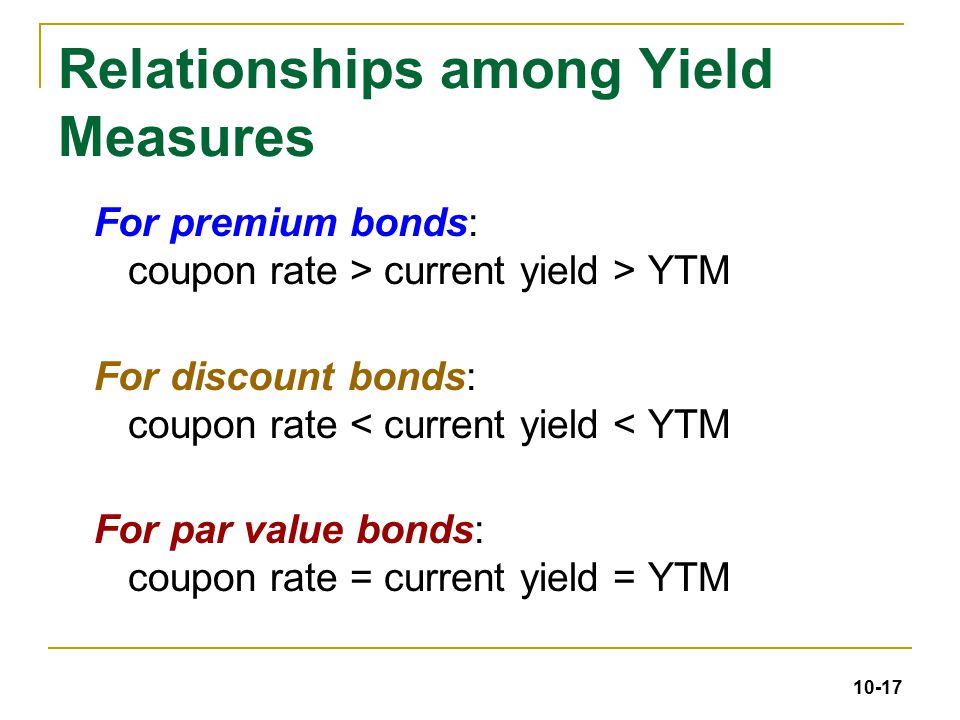

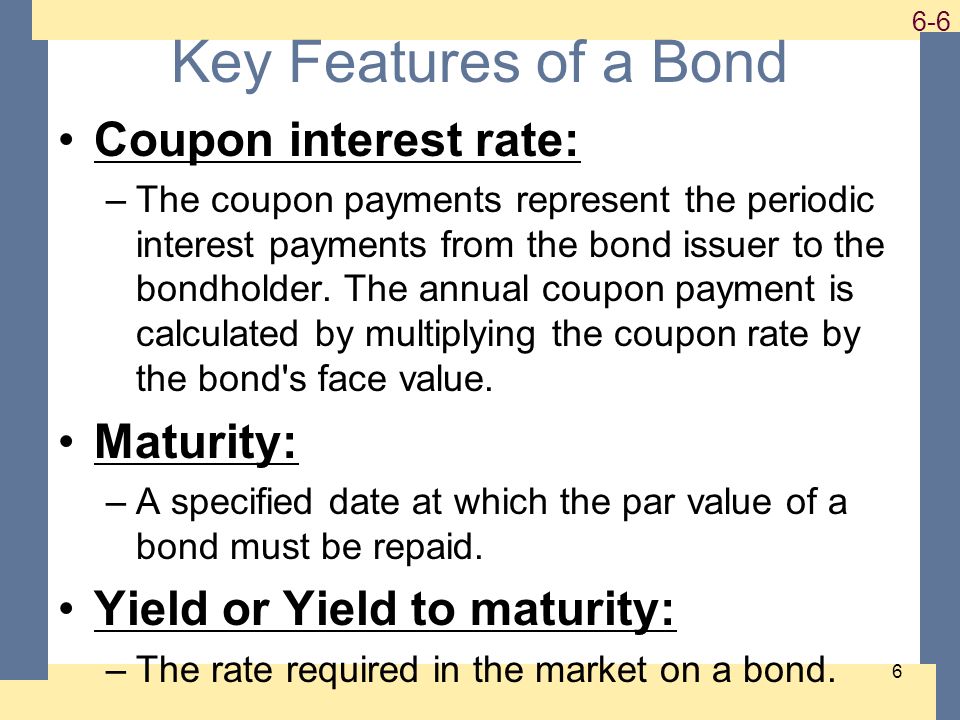

Current Yield - Relationship Between Yield To Maturity and ... a premium: coupon yield > current yield > YTM; par: YTM = current yield = coupon yield. Current Yield = Total Yield - Capital Gains Yield. The current yield is the annual payment divided by the price. Algebraically expressed as Y = R/P, where Y is yield, R is the annual payment, and P represents price. This creation shows the fine line between high and low returns over more than one period. Difference Between YTM and Coupon rates 14.01.2010 · 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as … What is the difference between the YTM and the coupon rate? The coupon rate is the interest rate on the bond at the time of issue. The YTM or Yield to Maturity is the yield based on the current price of the bond. For example, if a $1000 bond maturing in 10 years is issued at 5%, then 5% is the coupon rate, which means it will always pay $50 per year until maturity. Important Differences Between Coupon and Yield to Maturity A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can expect to receive 2% per year for the ...

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate ...

Difference Between YTM and Coupon rates Nevertheless, the term 'coupon' is still used, even though the physical object is no longer implemented. Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2.

Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ...

Coupon Rate - Meaning, Calculation and Importance - Scripbox Following is the relationship between the bond prices with the couponrate and YTM. Purchase Price of a Bond: Coupon Rate: Yield to Maturity (YTM) Face Value: 15%: 15%: Higher than the face value (at a premium) 15%: Lower than the coupon rate: Lower than the face value (at a discount) 15%:

Relationship Between Coupon Rate And Ytm The great news is that I have plenty of products to relationship between coupon rate and ytm use in February and I also have lots of items I can way basics coupons this month. Ll Bean Credit Card Coupons. fasttech coupon feb 2014 For more details about car insurance excesses and quotes in general, visit our car insurance comparison guide. Enter ...

Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon...

The Relation of Interest Rate & Yield to Maturity 19.04.2017 · Most brokerage firms offer YTM estimates on potential purchases, and there are number of online calculators you can use to make estimates based on coupon rate and …

The Difference Between Coupon and Yield to Maturity - The Balance 04.03.2021 · Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, …

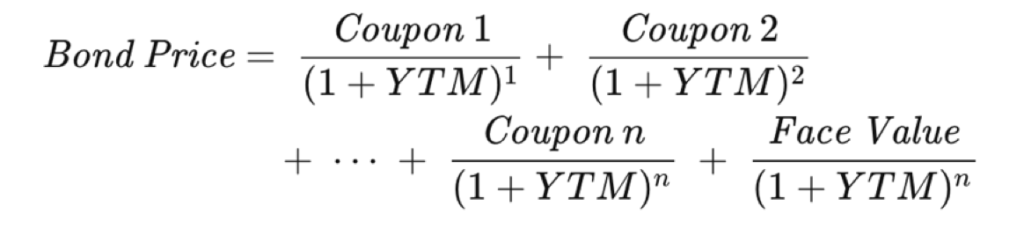

Bond Yield | Nominal Yield vs Current Yield vs YTM - XPLAIND.com Where P 0 is the current bond price, c is the annual coupon rate, m is the number of coupon payments per year, YTM is the yield to maturity, n is the number of years the bond has till maturity and F is the face value of the bond.. The above equation must be solved through hit-and-trial method, i.e. you plug-in different numbers till you get the right hand side of the equation equal to the left ...

Relationship Between Coupon and Yield - Assignment Worker Coupon rate = 14%, semiannual coupons YTM = 16% Maturity = 7 years Par value = $1,000 Slide 14 6-14 Example 7.1 • Semiannual coupon = $70 • Semiannual yield = 8% • Periods to maturity = 14 • Bond value = • 70 [1 - 1/ (1.08)14] / .08 + 1000 / (1.08)14 = 917.56 ( ) ( )2t 2t 2 YTM1 F 2 YTM 2 YTM1 1 -1 2 C Value Bond + + + =

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond.

What relationship between a bond's coupon rate and a bond's yield would ... Let's say you own a bond that you paid $1,000 for and it has a coupon rate of 10%. That means that this Bond will pay $100 per year in interest no matter what its price on the market. Therefore , your yield is also 10%. Now let's say that there is exactly one year left on this Bond. That is, this Bond will mature in exactly one year.

YTM AND ITS INVERSE RELATION WITH MARKET PRICE | India - The Fixed Income Example 2 (YTM and market price relation): Let's consider the existing bond used in example 1 above, which has a face value of ₹100, market price of ₹110, annual coupon rate of 7.5% paid semi-annually, term to maturity of 9 years, and YTM of 6.085%.

📈If a bond is trading at a premium, what is the relationship between ... A bond purchased at a premium, it will have a yield to maturity and current yield that is lower than its coupon rate.. What is a Premium bond? This is usually above its face value which may be as a result of the interest rate being higher than the current market interest rates.. When a bond is traded at a premium, the yield to maturity and current yield will be lower than its coupon rate.

Basis Point Value - Overview, Bond Yields and Prices The par value of the bond must also be repaid by the issuer on the date of maturity. Therefore, bond yield can be calculated by dividing the total coupon payments by the face value of the bond. Yield to Maturity (YTM) However, simply using coupon rates and face value is an incomplete calculation of total bond yield.

Relationship Between Yield To Maturity and Coupon Rate Relationship Between Yield To Maturity and Coupon Rate. The concept of current yield is closely related to other bond concepts, including yield to maturity, and coupon yield. When a bond …

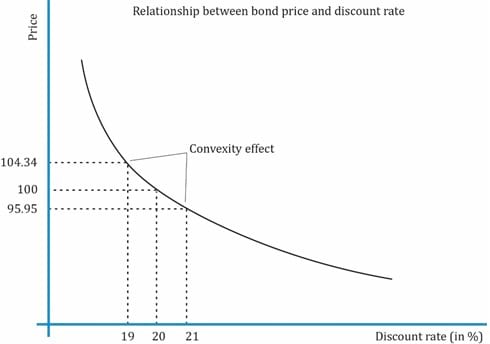

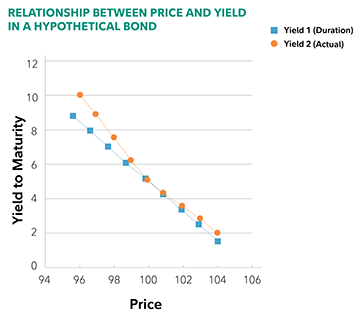

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate.

Returns, Spreads, and Yields | AnalystPrep - FRM Part 1 Study Notes If the coupon rate < YTM, the bond will sell for less than par value, or at a discount. If coupon rate= YTM, the bond will sell for par value. Over time, the price of premium bonds will gradually fall until they trade at par value at maturity. Similarly, the price of discount bonds will gradually rise to par value as maturity gets closer.

Relationship between bond price and YTM - brainmass.com The yield to maturity (YTM) is the required return by the investor on the bond. It is calculated by discounting the expected cash flows by the required return an dequating these discounted cash flows to the price of the bond. The relationship can be expressed matematically as. Price=Discounted Cash Flows (Interest+Principal) at rate Kd.

What relationship between a bond’s coupon rate and a bond’s … It is crucial to understand the difference between a bond’s coupon interest rate and its yield. The yield represents the effective interest rate on the bond, determined by the relationship …

Difference between YTM and Coupon Rates 20.05.2022 · YTM accounts for both the interest payments made (the coupon rate) as well as any capital gains or losses. A coupon rate, on the other hand, is simply the interest rate that is …

Concept 82: Relationships among a Bond’s Price, Coupon … A bond’s price moves inversely with its YTM. An increase in YTM decreases the price and a decrease in YTM increases the price of a bond. The relationship between a bond’s price …

:max_bytes(150000):strip_icc()/female-executive-talking-to-colleagues-117455512-5750d4d75f9b5892e8b3d3af.jpg)

Post a Comment for "44 relationship between coupon rate and ytm"